Natural gas is at the forefront of the conversation about national energy independence. New drilling technologies can now free up gas trapped between geologic layers by extending horizontal wells deep beneath the earth’s surface.

Natural gas is at the forefront of the conversation about national energy independence. New drilling technologies can now free up gas trapped between geologic layers by extending horizontal wells deep beneath the earth’s surface.

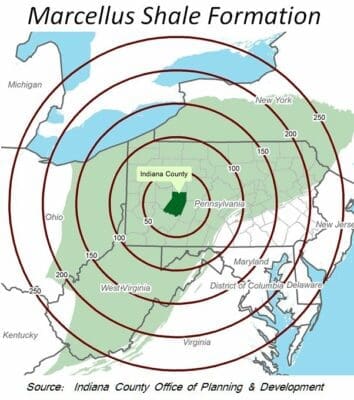

The Marcellus Shale play is a geologic formation that extends from Ohio and West Virginia on its southwest side through New York on its northeast end. It’s located close to population centers in the Northeastern United States, so reduced transportation costs and high demand create an economic advantage.

Located in the heart of the Marcellus Shale, Indiana County is perfectly positioned to encourage companies to explore, produce, and export gas while supporting the drilling industry in general.

Implications for the Future

Marcellus shale likely contains enough natural gas reserves to fuel the nation’s energy needs for the next 50 years. Beneath the Marcellus Shale formation lies another shale formation (the Utica), which also contains significant natural gas reserves.

In recent years, natural gas extraction from within the Marcellus Shale formation has intensified gas drilling within Indiana County. While other industry sectors have stagnated somewhat in the past several years, Pennsylvania’s natural resources and mining sector has increased.

In recent years, natural gas extraction from within the Marcellus Shale formation has intensified gas drilling within Indiana County. While other industry sectors have stagnated somewhat in the past several years, Pennsylvania’s natural resources and mining sector has increased.

Along with abundant economic opportunities, Marcellus shale development will generate many challenges:

- Planning for expected growth

- Long-term preparation for economic decline if drilling activities peak and diminish

- Addressing environmental concerns

- Accommodating increased population, student enrollments, and needs for housing, public services and public safety

- Increased demands on transportation infrastructure and water and sewer systems

- Policy considerations for local officials and citizenry to pay for increased infrastructure needs

- Changes to the landscape through installation of multi-acre drilling pads, access roads, above-ground wellheads, and transmission pipelines.

More Information for Marcellus Businesses and Job Seekers

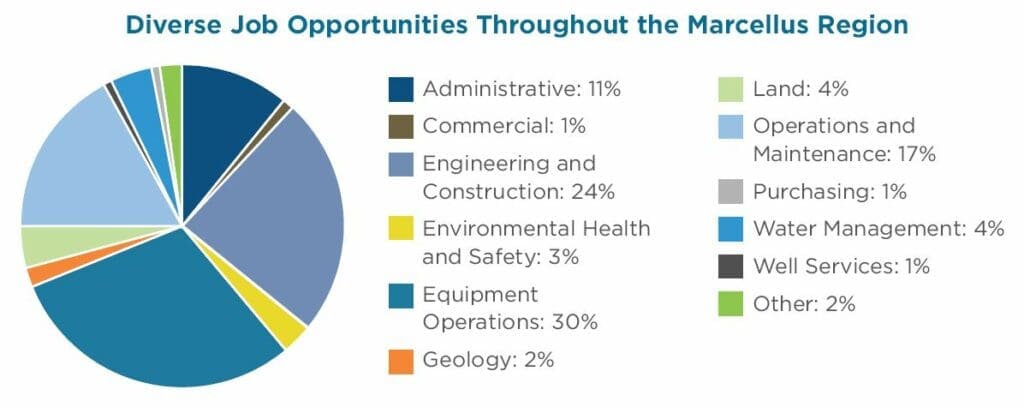

Employment in the oil and gas industries had relatively low levels of employment from 1980 to 2005, averaging about 250 jobs annually. Since 2005, however, employment in oil and gas operations has increased almost 70%, largely due to recent activities related to Marcellus Shale exploration. The sector represents less than 1 percent of the state’s total workforce while it generated 8 percent of the state’s total job growth in 2011.

Traditional natural resource businesses will need more workers with greater technical skills, as well as lower-skill workers that work long hours but receive family-sustaining wages. The near term demands of the Marcellus Shale natural gas play, for example, will generate demand for more workers at both ends of the technology-skill spectrum. Meeting that demand may also trigger a migration within the existing labor force, as some workers may leave current jobs to accept higher-paying positions in the natural gas industry.

Get more information from the CEO on workforce development and training for the natural gas industry.